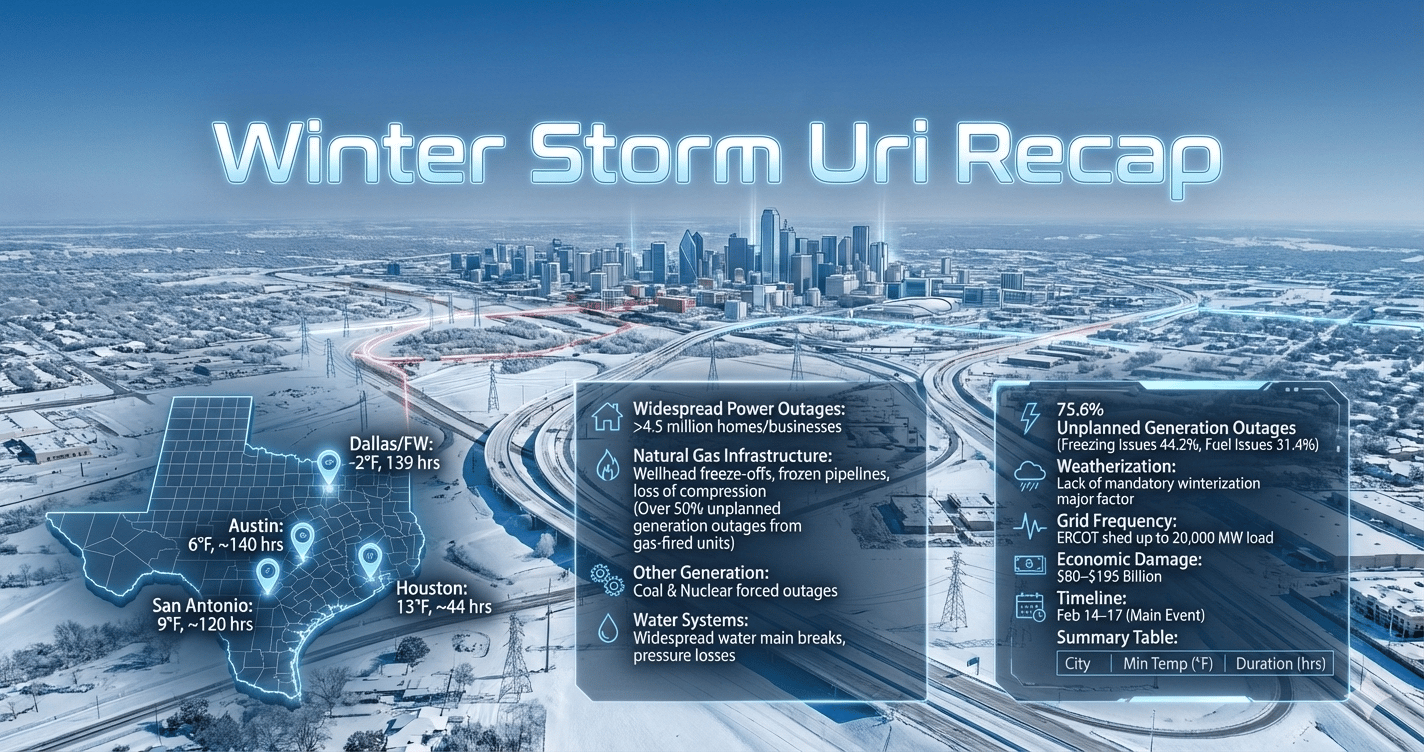

During Winter Storm Uri (February 2021), Texas experienced a historic and catastrophic cold snap that severely impacted both energy demand and infrastructure. Here are the key details:

Minimum Temperatures and Duration (Texas, ERCOT/Balancing Authority Region)

Dallas/Fort Worth: Reached a record low of −2°F (−19°C) on February 16, 2021.

Austin: Recorded a low of 6°F (−14°C).

San Antonio: Dropped to 9°F (−13°C).

Houston: Hit 13°F (−11°C).

Duration: Many areas experienced consecutive sub-freezing temperatures for 5–7 days. For example, DFW saw 139 consecutive hours at or below freezing; Waco recorded 205 hours.

Timeline

Feb 10–11: Initial freezing rain and ice accumulations.

Feb 14–17: Main snow/ice event and coldest temperatures.

Feb 15–18: Widespread power outages and rolling blackouts.

Feb 19: Temperatures began to moderate.

Impact on Texas Energy Infrastructure

Widespread Power Outages: Over 4.5 million homes and businesses lost power, some for up to 4 days.

Natural Gas Infrastructure: The primary cause of power generation failures was the loss of natural gas supply due to wellhead freeze-offs, frozen pipelines, and loss of compression. Over 50% of unplanned generation outages were from gas-fired units.

Other Generation: Coal and nuclear plants also experienced forced outages due to frozen equipment and lack of fuel supply.

Wind/Solar: Wind turbines did freeze, but the majority of lost generation was from thermal (gas/coal/nuclear) units.

Water Systems: Widespread water main breaks and pressure losses due to frozen pipes and loss of power to water treatment plants.

Economic Damage: Estimated at $80–$195 billion in total damages, the most expensive disaster in Texas history.

Key Takeaways from FERC/NERC and Academic Reports

75.6% of unplanned generating unit outages were due to freezing issues (44.2%) and fuel issues (31.4%).

Natural gas supply issues were responsible for the majority of fuel-related outages, with 43.3% of gas production declines caused by freezing, and 21.5% by power losses to gas infrastructure.

Weatherization: Lack of mandatory winterization for both power plants and gas infrastructure was a major factor.

Grid Frequency: ERCOT was forced to shed up to 20,000 MW of load to prevent a total grid collapse.

Summary Table: Minimum Temps & Duration (Major Texas Cities, Feb 2021)

City | Min Temp (°F) | Sub-Freezing Duration (hrs) |

|---|---|---|

Dallas/FW | -2 | 139 |

Austin | 6 | ~140 |

San Antonio | 9 | ~120 |

Houston | 13 | ~44 |

Infrastructure Damage Highlights

Power plants (gas, coal, nuclear) forced offline by frozen equipment and lack of fuel.

Natural gas production and pipeline systems froze, compounding generation outages.

Water systems failed due to frozen pipes and loss of power.

Widespread residential and commercial property damage from burst pipes.

Spot Cash Price Markets That Reacted

Texas/Oklahoma/Louisiana Hubs:

Houston Ship Channel (HSC), Waha Hub, Katy Hub, NGPL TexOk, Henry Hub (Louisiana): All saw explosive price spikes. During Uri, HSC and Waha traded above $400/MMBtu at the peak, while Henry Hub spiked but remained below $25/MMBtu due to greater liquidity and supply.

Midwest/Northeast Hubs:

Chicago Citygate, Dawn (Ontario), Algonquin Citygate (New England): Chicago and Algonquin saw sharp increases, with Algonquin Citygate exceeding $20–$30/MMBtu during severe cold snaps due to pipeline constraints and high demand.

West Coast:

SoCal Citygate, PG&E Citygate: Reacted with price volatility when pipeline flows from the Permian and Rockies were disrupted.

Market View:

The event was extremely bullish for natural gas and power prices in the short term due to massive demand spikes and supply destruction. However, it also exposed systemic weaknesses in Texas infrastructure, leading to regulatory and market reforms focused on winterization and resilience.

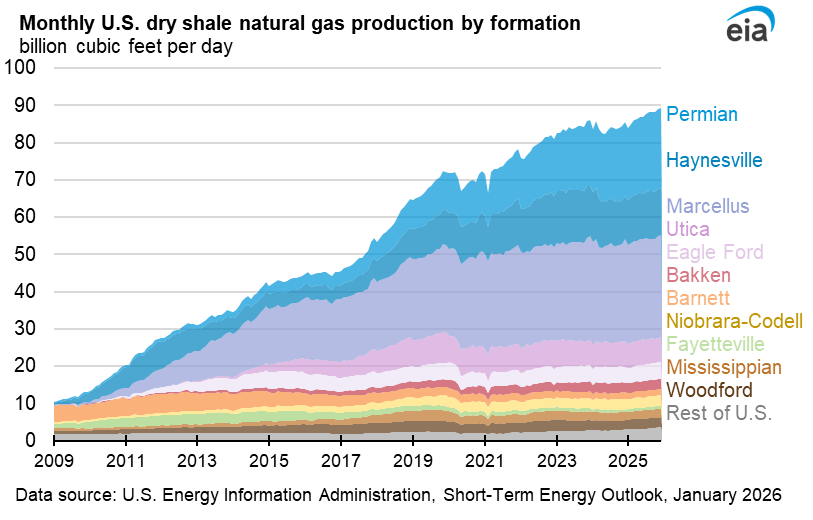

During Winter Storm Uri (February 2021), Texas experienced catastrophic natural gas production freeze-offs, with the largest impacts concentrated in the Permian, Eagle Ford, and Anadarko basins. The event led to the most severe supply destruction in Texas natural gas history.

Daily Freeze-Offs by Basin (Winter Storm Uri, Feb 2021)

Permian Basin:

Peak production loss: ~7–8 Bcf/d

Typical daily output pre-storm: ~13–14 Bcf/d

Production dropped by over 50% at the peak.

Eagle Ford:

Peak production loss: ~2–3 Bcf/d

Typical daily output pre-storm: ~6–7 Bcf/d

Production dropped by ~40%.

Anadarko (TX/OK Panhandle):

Peak production loss: ~2 Bcf/d

Typical daily output pre-storm: ~5 Bcf/d

Production dropped by ~40%.

Total Texas Freeze-Offs:

Statewide production fell from ~22 Bcf/d to as low as 8–10 Bcf/d at the trough, a loss of 12–14 Bcf/d.

Table: Estimated Daily Freeze-Offs by Basin (Feb 15–18, 2021)

Basin | Pre-Storm Output (Bcf/d) | Min Output (Bcf/d) | Max Daily Loss (Bcf/d) | % Loss |

|---|---|---|---|---|

Permian | 13.5 | 5.5 | 8.0 | 59% |

Eagle Ford | 6.5 | 3.5 | 3.0 | 46% |

Anadarko | 5.0 | 3.0 | 2.0 | 40% |

Total TX | 22.0 | 8.0 | 14.0 | 64% |

Source: EIA, FERC/NERC Final Report, UT Austin Energy Institute

Key Points:

Most freeze-offs occurred Feb 15–18, 2021, coinciding with the coldest temperatures and peak power outages.

Over 50% of Texas gas production was offline at the peak.

The Permian Basin was the single largest contributor to lost supply.

Freeze-offs were caused by wellhead icing, loss of power to gathering/compression, and frozen equipment.

Visual Reference:

EIA STEO: Lower48 US natural gas production by basin, showing the sharp drop during Feb 2021.

Market View: Bullish (at the time)

The scale and duration of freeze-offs created an extreme supply-demand imbalance, driving spot prices at Texas hubs (Waha, Houston Ship Channel) above $400/MMBtu.

The event exposed the vulnerability of Texas production to extreme cold and led to regulatory focus on winterization.

Rationale:

The unprecedented scale of production freeze-offs in the Permian, Eagle Ford, and Anadarko basins during Uri remains a key risk factor for Texas gas markets during future cold events. The structural exposure to freeze-offs is a persistent bullish tail risk for winter price volatility in the region.

References: