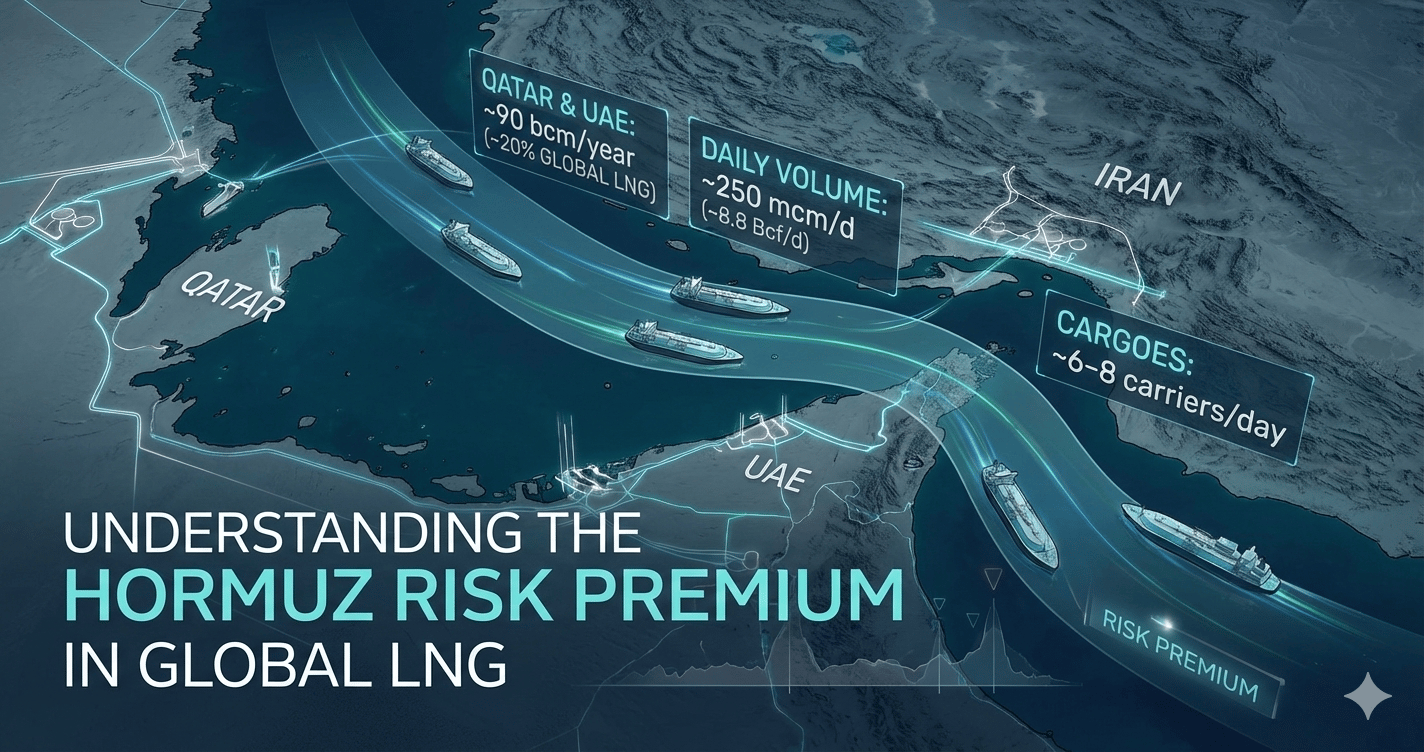

Daily LNG Volume Through the Strait of Hormuz (Qatar & UAE)

All LNG exports from Qatar and the UAE transit the Strait of Hormuz.

In 2023–2025, this accounted for ~90 bcm/year (Qatar: ~84 bcm, UAE: ~5.5 bcm), or about 20% of global LNG trade.

This equates to roughly 250 million cubic meters per day (mcm/d), or ~8.8 Bcf/d (Qatar: ~8.3 Bcf/d, UAE: ~0.5 Bcf/d).

On a cargo basis, this is typically 6–8 LNG carriers per day transiting the Strait.

Exporter | Annual LNG Exports (bcm) | Daily LNG Volume (Bcf/d) | Share of Global LNG |

|---|---|---|---|

Qatar | ~84 | ~8.3 | ~18% |

UAE | ~5.5 | ~0.5 | ~1% |

Total | ~90 | ~8.8 | ~20% |

Has the Strait of Hormuz Ever Been Closed to LNG Tankers?

No, the Strait of Hormuz has never been closed to LNG tankers, even during major Middle East conflicts (including the Iran-Iraq War, Gulf Wars, and recent Israel-Iran escalations).

While Iran has repeatedly threatened closure, and military tensions have led to increased risk premiums and occasional vessel delays, actual closure has never occurred.

The region’s exporters—including Iran—are highly dependent on the Strait for their own energy revenues, making a full closure a “nuclear option” with severe self-harm.

Market Implications

Bullish risk premium: Any credible threat to Hormuz transit injects significant upside risk into global LNG (JKM) and European gas (TTF) prices due to the lack of alternative export routes for Qatari and UAE LNG.

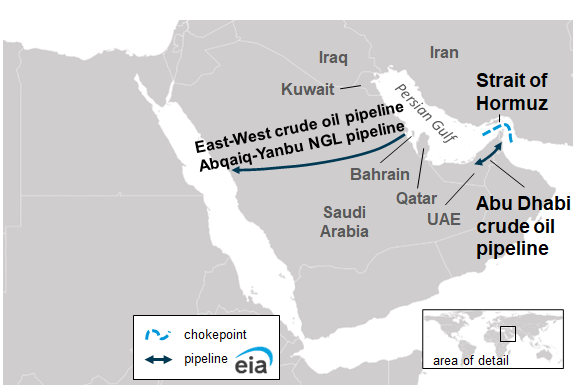

No viable bypass: Unlike oil, there are no pipelines or alternative maritime routes for LNG from Qatar/UAE to global markets. A closure would immediately remove ~20% of global LNG supply from the market.

Recent events: As of June 2025, despite missile attacks and heightened military activity, LNG flows have continued uninterrupted, though vessel tracking shows increased caution and occasional holding patterns near the Strait.

Visual: Strait of Hormuz – Global Oil & LNG Chokepoint

The Strait of Hormuz is the only route for Qatar and UAE LNG exports to reach global markets

Next Question:

Qatari LNG Flows: Europe vs. Asia (2025–2026)

Asia remains the dominant destination for Qatari LNG:

~80–85% of Qatar’s LNG exports go to Asia (China, India, Japan, South Korea, Pakistan, etc.).

~10–15% of Qatari LNG is delivered to Europe (mainly Italy, France, Belgium, UK, and recently Germany).

Recent Volumes (2024–2025):

Qatar exported ~80 million tonnes (mt) of LNG in 2024.

To Asia: ~64 mt (80%)

To Europe: ~12 mt (15%)

To other regions: ~4 mt (5%)

Region | Share of Qatari LNG Exports | Key Buyers (2024–2025) |

|---|---|---|

Asia | 80–85% | China (25%), India (17%), Japan, S. Korea, Pakistan, Kuwait |

Europe | 10–15% | Italy, France, Belgium, UK, Germany |

Europe’s share has declined in 2024–2025 as Qatar pivots more cargoes to Asia, where demand is higher and shipping is easier/logistically favored.

Europe’s LNG imports from Qatar were about 15.1 mt in 2023, but have dropped to ~10% of Qatar’s exports in early 2025 as more cargoes are redirected to Asia.

Price Response to Disruption

If Qatari LNG flows are disrupted (e.g., Strait of Hormuz closure):

Immediate loss: ~8.3 Bcf/d (20% of global LNG supply) removed from the market.

Asia most exposed: Key buyers like India, Pakistan, and China would face acute shortages.

Europe exposed: While less reliant than Asia, Europe would see a sharp drop in LNG supply, especially as Russian pipeline gas is now minimal.

Market Reaction:

Bullish shock: Spot LNG prices (JKM, TTF) would spike sharply in both Asia and Europe.

Inter-basin spreads: JKM and TTF would surge relative to Henry Hub, incentivizing maximum US LNG exports.

Global scramble: Price-sensitive buyers (e.g., South Asia) could be priced out, switching to coal or oil.

Shipping rates: LNG vessel rates would soar as ton-miles increase and rerouting occurs.

Historical precedent: Even minor shipping delays or threats in the Strait of Hormuz have added a risk premium to global LNG prices. A full disruption would be unprecedented and extremely bullish for global gas prices.

Summary Table: Qatari LNG Export Split (2024–2025)

Destination | % of Qatari LNG | 2024 Volume (mt) | Key Buyers |

|---|---|---|---|

Asia | 80–85% | ~64 | China, India, Japan |

Europe | 10–15% | ~12 | Italy, France, UK |

Other | ~5% | ~4 | Middle East, LatAm |

References: