What’s your next question? Ask to get the details.

If the United States were to take control of all Venezuelan oil assets, the ramifications for global oil markets would be profound and multi-layered. The move would trigger immediate supply disruptions, reshape trade flows, and fundamentally alter OPEC+ dynamics, with knock-on effects across crude, products, FX, debt, and equities. While the short-term effect would be bullish for prices and volatility, the medium-term would be structurally bearish as Venezuelan output ramps up and OPEC+ cohesion weakens.

1. Venezuela’s Oil Sector: Reserves, Infrastructure, and Optimization Potential

Key Upstream Regions & Assets

Orinoco Belt (Faja del Orinoco):

Holds the world’s largest recoverable oil reserves (~300+ billion bbls, mostly extra-heavy crude, 8–10° API).

Divided into Ayacucho, Carabobo, Junín, Boyacá sectors; main JVs include Petropiar, Petrocedeno, Petromonagas, Petrocarabobo.

Upgraders (convert extra-heavy to syncrude): Combined nameplate ~600 kbbl/d, actual output <500 kbbl/d due to chronic maintenance issues.

Maracaibo Basin:

Mature fields (La Rosa, Lagunillas, Tía Juana) producing lighter/medium crudes, but declining without enhanced oil recovery (EOR).

Maturín Sub-basin:

Notable fields: El Furrial, Santa Barbara, El Carito (conventional oil, also in decline).

Infrastructure

Pipelines: Aging, leak-prone, and undermaintained; main lines connect Orinoco to upgraders/export terminals (Jose, Puerto La Cruz).

Export Terminals: Jose (heavy crude), Puerto La Cruz, Amuay/Cardón (Paraguaná Refining Complex).

Refineries: Domestic nameplate ~1.1 mmbbl/d (Amuay, Cardón, Puerto La Cruz, El Palito), but utilization <30%.

Asset Ownership

PDVSA: State-owned, minimum 60% in all JVs.

Foreign JVs: Chevron, CNPC, Rosneft, ENI, Repsol, TotalEnergies, Maurel & Prom.

Citgo: Former PDVSA US refining asset, now in creditor-controlled process.

Fastest Optimization Levers

Lever | Timeline | Upside Potential |

|---|---|---|

Well workovers/reactivation | 0–12 months | +200–300 kbbl/d |

Diluent imports | 0–6 months | +100–200 kbbl/d |

Upgrader repairs | 6–18 months | +100–150 kbbl/d |

Pipeline/terminal repairs | 1–3 years | +200–400 kbbl/d |

EOR in mature fields | 1–3 years | +100–200 kbbl/d |

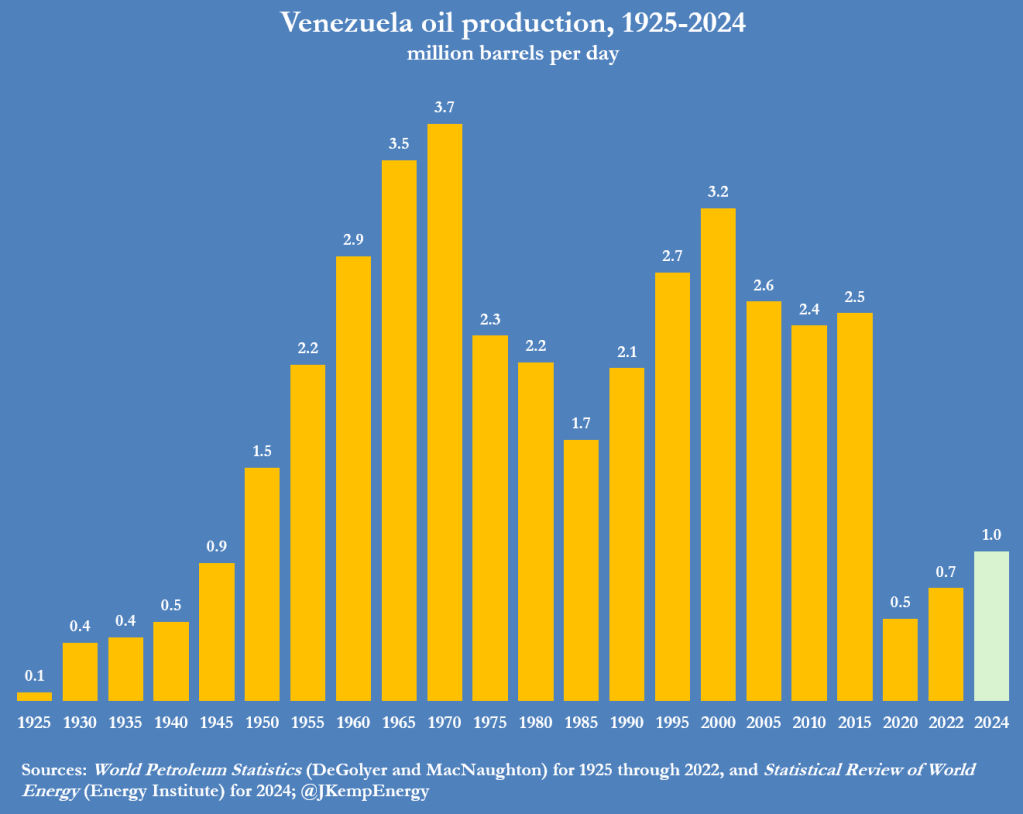

Current output (Q1 2026): ~900 kbbl/d

Potential (12 months): 1.1–1.2 mmbbl/d

Medium-term (2–3 years): Up to 2.0 mmbbl/d

Long-term (5+ years): 2.5–3.0 mmbbl/d (with $20–30B+ investment)

Venezuela’s output peaked near 3.5 mmbbl/d in the late 1990s, now below 1 mmbbl/d. Rapid recovery to 2 mmbbl/d possible with focused investment and operational improvements.

2. Immediate and Medium-Term Global Oil Market Impacts

Short-Term (0–12 months): Supply Shock & Volatility

Export Disruption:

Initial disruption of ~1.0–1.1 mmbbl/d of Venezuelan exports, mainly to China and Cuba.

Tightens heavy crude supply in the Atlantic Basin, supporting WTI and Brent prices.

Heavy Sour Crude Premiums:

US Gulf Coast refineries (optimized for heavy sour) face supply squeeze, widening Maya/WTI and Mars/WTI spreads.

Insurance & Freight:

Maritime risk premiums spike for Caribbean/Gulf tankers.

Medium-Term (1–3 years): Bearish Supply Growth

Production Ramp:

US investment and operational reset could add 1–2 mmbbl/d to global supply, exacerbating the oversupply forecast for 2026.

Trade Flow Reconfiguration:

USGC refineries absorb more Venezuelan crude, reducing imports from Canada/Mexico.

China loses discounted barrels, increases demand for Russian, Middle Eastern, West African grades.

Europe faces indirect impacts via products and heavier competition for non-US heavy crudes.

Macro & Geopolitical Considerations

US-China Tensions:

China diversifies crude sourcing, increasing global competition and logistical costs.

OPEC+ Dynamics:

Venezuela’s surge (under US control) undermines OPEC+ quota discipline, risks market-share war.

Emerging Market FX:

Oil exporters’ currencies (CAD, MXN) weaken; LatAm FX may strengthen on improved regional sentiment.

3. OPEC+ Quota Dynamics: Cohesion at Risk

Venezuela has been exempt from quotas due to underproduction.

US-driven output surge would be “outside” OPEC+ system, undermining the group’s ability to balance the market.

Saudi, Russia, and others face market share losses, leading to increased quota cheating and risk of a price war.

OPEC+ announcements become less effective, eroding price-setting power and increasing volatility.

Issue | Current OPEC+ | With US-Venezuela |

|---|---|---|

Quota compliance | Low | Lower |

Spare capacity | Tight | Looser (bearish) |

Market share fight | Moderate | High |

Cohesion | Fragile | At risk |

4. Asset Class Trade Ideas

Asset Class | Trade Idea | Rationale |

|---|---|---|

Oil Futures | Short Brent/WTI (medium-term) | Anticipate oversupply as Venezuelan output rises under US management |

Crack Spreads | Long USGC coking cracks (short-term) | Disruption in heavy crude supply boosts coker margins |

Freight/Insurance | Long tanker insurance, freight indices | Maritime risk premiums spike on conflict or transition |

EM Debt | Long Venezuela/PDVSA distressed bonds | Expect restructuring and recovery under US stewardship |

FX | Short CAD, MXN; Long selective LatAm FX | Lower oil prices hurt Canada/Mexico; regional risk premium may fall post-intervention |

Equities | Long US refiners (VLO, MPC), Midstream (PAA) | Improved access to heavy crude, better margins; midstream benefits from new flows |

Gold | Long gold | Geopolitical risk and inflation hedge amid transition |

5. Summary View

Short-term: Bullish for oil prices, volatility, heavy crude spreads, insurance/freight.

Medium-term: Bearish for oil prices as Venezuelan output ramps up and OPEC+ discipline erodes.

OPEC+ cohesion: At risk; quota announcements lose market impact.

Best trades: Short Brent/WTI, long USGC coker cracks, long Venezuela distressed debt, long gold, short CAD/MXN.

Rationale:

US control of Venezuelan oil would initially disrupt supply and drive volatility, but ultimately add significant barrels to a market already facing oversupply. The move would weaken OPEC+’s price-setting power, accelerate market-share competition, and pressure global oil prices—reshaping flows, spreads, and asset class performance across the board.