Here’s a concise, market-focused analysis of the latest PJM 2026–2030 load forecast, drivers of change, nodal/zonal exposure, supply outlook, infrastructure/regulatory risks, and implications for Power and Northeast Gas basis traders.

PJM 2026–2030 Load Forecast: Key Takeaways

Headline Growth:

PJM’s 2026 Long-Term Load Forecast (Jan 2026) projects RTO-wide summer peak load to grow at 3.6%/yr (10-yr avg), reaching ~222 GW by 2036 (up ~66 GW from today).

Winter peak load is forecast to grow even faster at 4.0%/yr, reaching ~205 GW by 2036.

Net energy for load is expected to increase by 4.8%/yr over the next decade.

Change vs. Prior Forecast:

Near-term (2026–2032) peak demand was revised down by 0.7–2.6% vs. last year, mainly due to:

Stricter vetting of large load (data center) requests

Softer economic/EV adoption assumptions

Long-term growth remains robust, with the main risk being the timing of large load additions, not the magnitude.

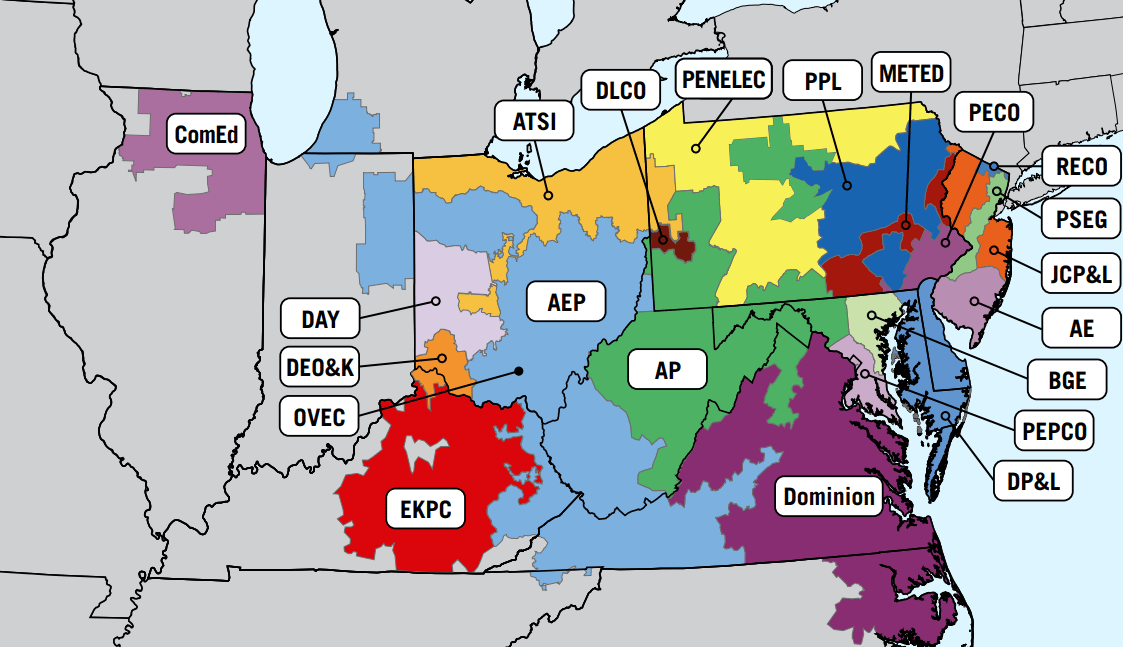

Zonal/Nodal Load Growth Exposure:

Data center-driven growth is concentrated in:

Dominion (DOM, VA): 5.4%/yr

PPL Electric (PPL, PA): 6.4%/yr

AEP (OH/WV): 5.3%/yr

DPL (DE): 5.2%/yr

ComEd (IL): 3.9%/yr

Other notable zones: PECO, BGE, ATSI, APS, JCPL, METED, PL, PEPCO, PS (see map below).

PJM Zonal Map: Key growth zones highlighted above.

Supply Outlook: Can Generation Keep Up?

Supply additions are lagging load growth. PJM’s latest capacity auction (2027/28) cleared at the price cap ($333.34/MW-day) and failed to meet the target reserve margin by 6.6 GW UCAP (14.8% IRM vs. 20% target).

Retirements: Up to 25–35% of the current thermal fleet could retire by 2040 (aging, policy, economics).

New builds: Over 95% of the interconnection queue is renewables/storage, but actual completion rates are low due to permitting, supply chain, and financing bottlenecks.

Best-fit generation: Fast-ramping, dispatchable resources (gas CTs, batteries) are critical for reliability; renewables alone cannot meet peak/firming needs.

Infrastructure & Regulatory Bottlenecks

Transmission: Northern Virginia (DOM) and Eastern PA/NJ face severe transmission constraints; upgrades are slow and costly.

Natural Gas: Pipeline expansions (e.g., Transco REA) are at risk from legal challenges, threatening up to 20 GW of gas-fired generation in eastern PJM.

Regulatory: PJM is reforming its interconnection and load adjustment processes, but uncertainty remains on how/when large loads are integrated.

Backstop auctions: If reserve margins remain short, PJM may trigger emergency or reliability backstop auctions.

Trump Administration Proposal: ‘Emergency’ Auction for Data Centers

The Trump administration is pushing PJM to hold an “emergency” capacity auction to ensure enough supply for data centers, especially in Northern Virginia.

This could fast-track procurement of firm, dispatchable capacity—likely favoring new gas, batteries, or even small modular nuclear—potentially at premium prices.

Implications for Traders

PJM Power Traders: Bullish

Capacity and forward power prices are structurally supported by:

Explosive load growth (esp. data centers)

Slow supply response and high risk of reserve margin shortfalls

Regulatory and infrastructure bottlenecks

Expect elevated volatility and scarcity pricing, especially in DOM, PPL, and ComEd zones.

Northeast Gas Basis Traders: Bullish to Neutral

Gas-fired generation remains the backbone of PJM’s supply stack (>44% of generation).

Pipeline constraints (Transco, etc.) and rising power sector demand support bullish basis, especially in eastern PJM (Transco Z6 NY, Tetco M3).

However, behind-the-meter and non-grid solutions (e.g., on-site gas, nuclear, batteries) for data centers could temper some incremental demand.

Summary Table: PJM 2026–2030 Load & Supply Outlook

Metric | 2026 | 2030 | 2036 | CAGR (2026–36) |

|---|---|---|---|---|

Summer Peak (MW) | ~170k | ~200k | 222k | 3.6% |

Winter Peak (MW) | ~145k | ~175k | 205k | 4.0% |

Net Energy (GWh) | ~950k | ~1,150k | ~1,328k | 4.8% |

Capacity Margin | Tight | Tighter | At risk | — |

Main Load Growth Zones | DOM, PPL, AEP, DPL, ComEd | — | — | — |

Bottom Line:

PJM faces unprecedented load growth, driven by data centers and electrification, with supply struggling to keep pace due to slow buildout, retirements, and infrastructure bottlenecks. Power and gas basis traders should position for structurally bullish fundamentals, especially in the fastest-growing and most constrained zones.

References:

For a deeper dive into nodal/zonal exposures or regulatory developments, see PJM’s full load forecast and capacity auction documentation.