1. Half-Cycle Economics & Curtailment Triggers

Breakeven Economics (2026):

Core Haynesville (Louisiana): $2.40–$2.85/MMBtu (half-cycle, top-tier acreage)

Western Haynesville (TX): $2.70–$3.75/MMBtu (improving, but higher due to infrastructure and well cost)

Full-basin average: $3.50–$3.75/MMBtu for most new development; some operators require $5.00/MMBtu for new growth (Aethon, EXE)

Sub-$3.00/MMBtu: Only the very best wells break even; basin-wide activity falls sharply below $2.75/MMBtu

Curtailment/Activity Reduction Thresholds:

Rigs/Completions begin to drop: $3.25–$3.50/MMBtu (Henry Hub)

Widespread curtailments: $2.75–$3.00/MMBtu (local basis-adjusted)

Historical behavior: At $2.50–$2.75/MMBtu, most public and large private operators cut rigs, delay TILs, and may shut-in high-cost volumes.

Henry Hub Price ($/MMBtu) | Operator Response (2026) | Production at Risk (Bcf/d) |

|---|---|---|

$4.00+ | Growth, DUC draw, rig adds | 0 |

$3.50–$4.00 | Maintenance, selective growth | 0–1 |

$3.00–$3.50 | Rig cuts, DUC burn, TIL delays | 1–2 |

$2.75–$3.00 | Widespread curtailments, shut-ins | 2–3 |

<$2.75 | Only core, lowest-cost runs | 3+ |

2. Major Operators & Recent Guidance

Public:

Expand Energy (EXE): Largest US gas producer, ~3.2 Bcf/d Haynesville. 2026 capex guided for “maintenance mode” unless prices rise “materially higher” than $3.50/MMBtu. No plans to add rigs at current strip.

Comstock Resources (CRK): ~4–6 rigs, focus on Western Haynesville. Aggressively reducing D&C costs (now ~$31M/well). 2026 plan is “hold acreage,” with TILs and pad size flexible to price. No 2026 volume growth unless strip >$4.

BP: All have cut rigs or deferred TILs in 2025; BP is considering adding rigs if $4+ strip holds for 2026.

Private:

Aethon Energy: Largest private, 7 rigs, “maintenance mode” in 2025/26. Explicitly requires $5/MMBtu for growth.

GEP Haynesville II, Tellurian: Focused on core; breakevens $2.70–$3.20/MMBtu. No growth at sub-$3.50/MMBtu.

Recent Operator Commentary:

“We are not adding rigs until prices are materially higher than our $3.50 breakeven.” (EXE, Q3 2025)

“Aethon will not grow Haynesville output until we see $5 gas.” (Aethon, DUG Gas+ 2025)

“Western Haynesville is still on the learning curve, but costs are falling. 2026 focus is on holding acreage, not growth.” (CRK, Q3 2025)

3. Haynesville Output & Price Sensitivity

Current Output (Jan 2026): ~15.6 Bcf/d (EIA STEO, S&P Global)

Production at Risk (by $0.25 price steps):

At $3.75: Full growth, no curtailment

At $3.50: Maintenance, minor DUC draw

At $3.25: 1–1.5 Bcf/d at risk (marginal, higher-cost wells)

At $3.00: 2–3 Bcf/d at risk (non-core, Western Haynesville, high-GP&T cost wells)

At $2.75: Up to 3+ Bcf/d at risk (widespread shut-ins, only core remains)

DUC Inventory: Elevated in East Texas, DUC draw supports short-term output but unsustainable below $3.25.

4. Acreage Risk & 2026 Guidance

Acreage Expiry: 2026 drilling programs are designed to “hold by production” term acreage, especially in Western Haynesville. Most public operators have flexibility to delay non-core development.

Frac/Completion Activity: Frac crew counts are directly tied to price. EXE, CRK, and Aethon all cut crews in 2025 and will only ramp if strip exceeds $4.00.

Infrastructure: Western Haynesville growth is gated by gathering and compression. Even at $4.00+, midstream buildout is a bottleneck.

5. Summary Table: Operator Economics & Behavior

Operator | 2026 Haynesville Output (Bcf/d) | Breakeven ($/MMBtu) | 2026 Guidance/Behavior |

|---|---|---|---|

Expand Energy | ~3.2 | $2.75–$3.50 | Maintenance, no rig adds < $4 |

Comstock (CRK) | ~2.5 | $2.70–$3.75 | Hold acreage, flexible TILs |

Aethon Energy | ~2.0 | $3.50–$5.00 | Maintenance, no growth < $5 |

BP | ~0.5 | $3.00–$3.75 | May add rigs if $4+ strip holds |

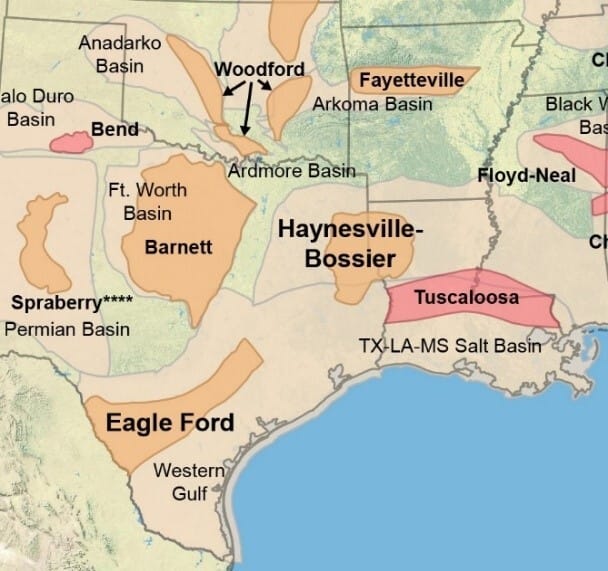

6. Visual Reference

Haynesville Basin Map

Market View:

Neutral-to-Slightly Bullish for 2026.

Prices above $3.75/MMBtu will incentivize rig adds and output growth, but below $3.25/MMBtu, expect sharp activity reductions and up to 2–3 Bcf/d of production at risk.

Operator discipline remains high; curtailments and deferred TILs will be used to protect balance sheets and acreage.

Key Risks:

Infrastructure bottlenecks in Western Haynesville.

Delayed LNG demand or new project slippage.

Price volatility from weather or global LNG markets.